Paul B Insurance Fundamentals Explained

Wiki Article

Getting My Paul B Insurance To Work

The thought is that the money paid out in claims over time will be much less than the complete premiums collected. You might seem like you're tossing money gone if you never sue, however having item of mind that you're covered in case you do suffer a substantial loss, can be worth its weight in gold.

Picture you pay $500 a year to guarantee your $200,000 house. You have ten years of paying, and also you have actually made no claims. That appears to $500 times ten years. This means you've paid $5,000 for home insurance coverage. You begin to question why you are paying a lot for absolutely nothing.

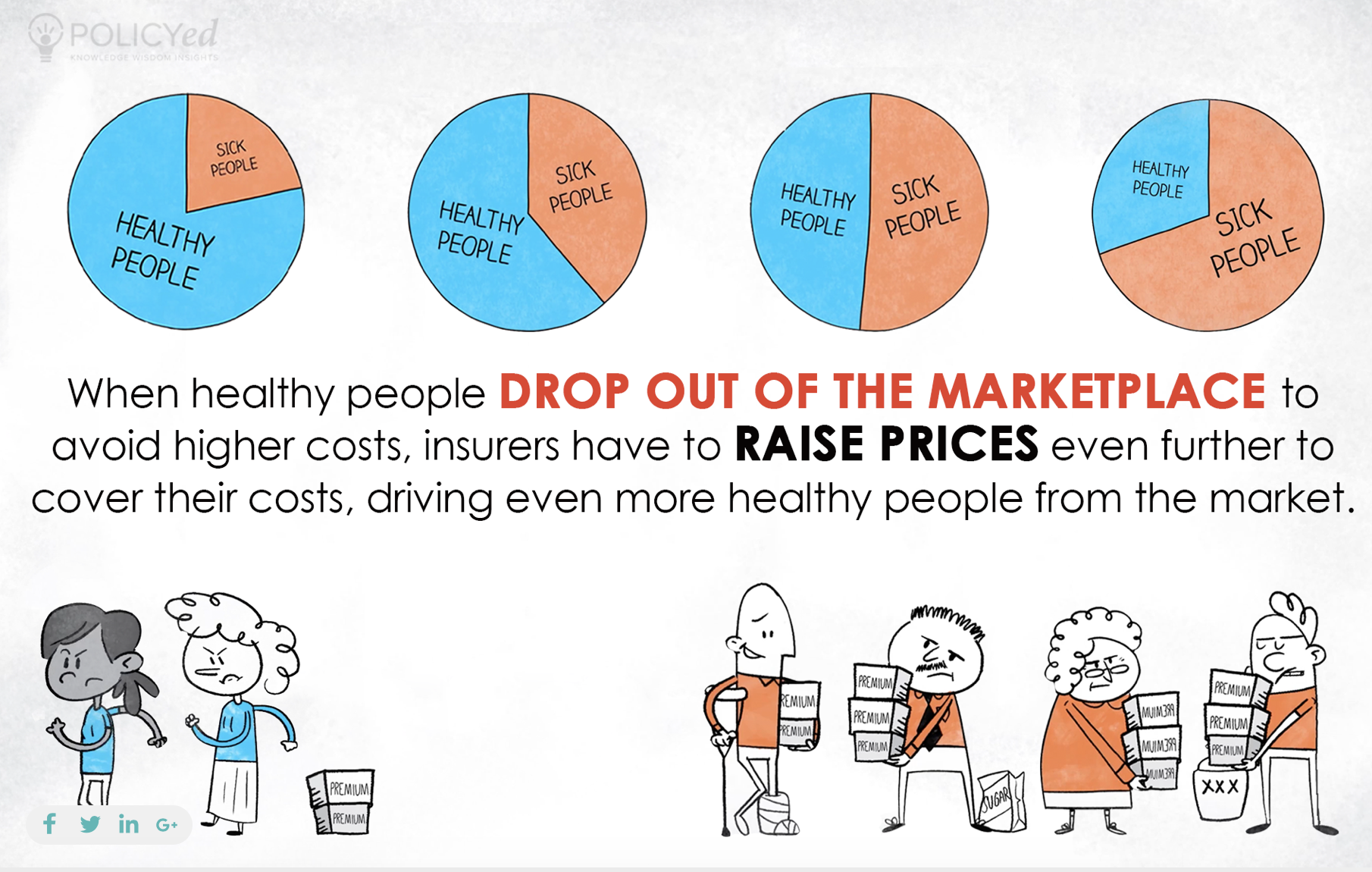

Because insurance policy is based on spreading out the danger amongst many individuals, it is the pooled money of all people paying for it that permits the business to build possessions and also cover cases when they happen. Insurance is a company. It would be wonderful for the firms to simply leave prices at the same level all the time, the fact is that they have to make adequate cash to cover all the potential claims their insurance holders may make.

9 Simple Techniques For Paul B Insurance

Underwriting modifications as well as rate boosts or decreases are based on results the insurance business had in past years. They market insurance coverage from only one firm.

The frontline people you deal with when you buy your insurance policy are the agents and brokers that represent the insurance coverage company. They a familiar with that business's items or offerings, but can not speak in the direction of various other firms' plans, pricing, or product offerings.

Just how much danger or loss of cash can you assume on your very own? Do you have the money to cover your prices or debts if you have a crash? Do you have special needs in your life that require extra insurance coverage?

Rumored Buzz on Paul B Insurance

The insurance coverage you need differs based on where you are at in your life, what type of properties you have, and also what your lengthy term objectives and also obligations are. That's why it is essential to make the effort to discuss what you want out of your plan with your agent.

If you secure a loan to get a car, and after that something takes place to the car, space insurance coverage will certainly pay off any section of your loan that basic vehicle insurance does not cover. Some lending institutions require their customers to lug gap insurance.

The major purpose of life insurance policy is to provide money for your recipients when you pass away. However just how you pass away can figure out whether the insurer pays out the survivor benefit. Relying on the kind of policy you have, life insurance coverage can cover: Natural deaths. Dying from a heart assault, illness or aging are examples of all-natural fatalities.

Little Known Facts About Paul B Insurance.

Life insurance policy covers the life of the insured individual. Term life insurance covers you for a period of time picked at purchase, such as 10, 20 or 30 years.

Term life is preferred because it provides big payments at a lower cost than long-term life. There are some variants of normal term life insurance policy plans.

Permanent life insurance policy plans construct cash value as they age. A portion of the premium visit here payments is included to the money worth, which can look at more info gain interest. The cash worth of entire life insurance policy plans expands at more info here a set rate, while the money value within universal policies can vary. You can use the cash value of your life insurance policy while you're still active.

Paul B Insurance - Questions

$500,000 of whole life protection for a healthy 30-year-old lady prices around $4,015 yearly, on standard. That same level of coverage with a 20-year term life policy would certainly set you back an average of concerning $188 annually, according to Quotacy, a brokerage company.

However, those financial investments feature more danger. Variable life is an additional long-term life insurance policy option. It seems a whole lot like variable universal life however is in fact various. It's an alternate to whole life with a set payment. However, insurance policy holders can make use of investment subaccounts to grow the money worth of the plan.

Below are some life insurance policy essentials to aid you much better recognize just how coverage works. For term life policies, these cover the cost of your insurance and administrative costs.

Report this wiki page